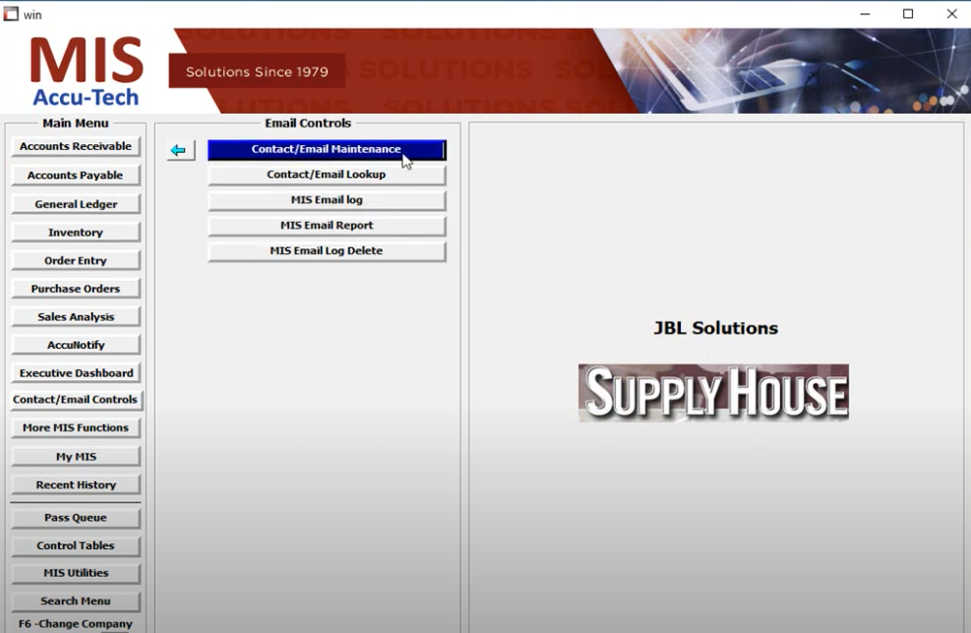

Accounts Receivable

The MIS Accounts Receivable Module monitors and presents the information you need for effective cash management. The module is tightly integrated with the MIS Order Entry and General Ledger modules.

Collections/Customer Credit Control – Get Paid Faster

The Collections/Cash Management section of the Accounts Receivable module consolidates and organizes the functions necessary to manage your customer accounts. Some of the functions included in this section are:

- Account Review

- Credit Manager Review

- Design-It-Yourself Credit Report

- Statements

- Dunning Notifications

- Various Aging Reports

- Due Date Register

- Collection Review & Report

- Collection Call Back Report

- And more!

Cash Receipts

The Cash Receipts function allows payment of invoices by oldest (on account) or specific. Deposits and miscellaneous cash receipts can also be entered. Discounts or short payments can be handled from within the cash receipts function and detailed invoice review is available on-line, thus saving time when an account adjustment is needed.

Sales Tax Management

The MIS system allows for multi-level tax codes. Tax code reporting provides the necessary information for tax forms (many taxing authorities accept the reports printed by the system), and you have the option to update the taxes due to the MIS Accounts Payable module.

Accounts Payable

The MIS Accounts Payable module provides a comprehensive solution for managing your expenditures and offers you flexible cash disbursement and check writing capabilities. Key reports and screens provide you with valuable business insights for more informed decision-making. The MIS Accounts Payable module integrates with the MIS Purchase Order and MIS General Ledger modules.

Check Writing and Outgoing Cash Management

Various cash requirements reports are available to assist you with cash flow planning. Immediate/demand check printing, ACH/EFT/Credit Card transactions, manual checks, and system generated check printing are supported for multiple bank accounts. Flexible payment selection/exclusion by Vendor, Payment Cycle, Dollar Amount Range, Vendor Classification, Due Date, Discount Date, and Promised Date.

Bank Account Reconciliation

The bank reconciliation function includes the monitoring and reconciliation of deposits, checks, and miscellaneous fees/transactions/journal entries the cash account from transactions entered directly through the General Ledger.

Unrecorded Liability Monitoring and Tracking

A major problem with many distributors and light fabricators is unrecorded liabilities (products that are received and possibly invoiced but not reflected in Accounts Payable). The MIS Unrecorded Liability function monitors and tracks products that have been received (and have become assets) but have not been set up to be paid in Accounts Payable.

General Ledger/Financials

The MIS General Ledger system is a comprehensive module that integrates with other MIS modules in order to provide you with the financial information needed to monitor receipts and disbursements. The MIS General Leger is always “live” as there is no need for nightly/batch processing.

Standard financial reporting along with supplemental reporting will allow you to tailor the format of your general ledger reports. The supplemental reporting feature was designed to provide additional flexibility and ease the workload of companies with multiple branches. The system supports user-defined formatting, multiple branches, multiple companies, multiple profit centers, on-line display of actual balances compared to last year and budgets, multiple open general ledger periods and previous period adjustments.

The MIS General Ledger Administrative function allows your Controller/CFO to control which periods are open and available for previous month(s) adjustments and activity.